About BAOBAB (Adansonia digitata)

The Baobab industry is one of Africa’s fastest-growing natural ingredients sectors. Baobab is a trans-boundary resource, with its fruit pods harvested in the wild by rural communities. It is found in 32 African countries including South Africa, Botswana, Namibia, Zimbabwe, Malawi, Ghana, Nigeria and Tanzania. Baobab trees are not cultivated, but there is a sapling project underway to repopulate wild spaces and help harvester communities to plant new trees. Baobab fruits and seeds have a long history of traditional use. Its fibrous bark is used to make rope, its leaves are eaten as a vegetable, the seeds produce oil, and the nutritious pulp is an important food source. Because Baobab has adapted to grow in low rainfall areas, it is often found where few other plants survive. Baobab has become an important economic sector, with ingredients and products produced and exported from at least ten countries. This is especially significant to the tens of thousands of mostly women harvesters who generate income from harvesting and selling the fruit.

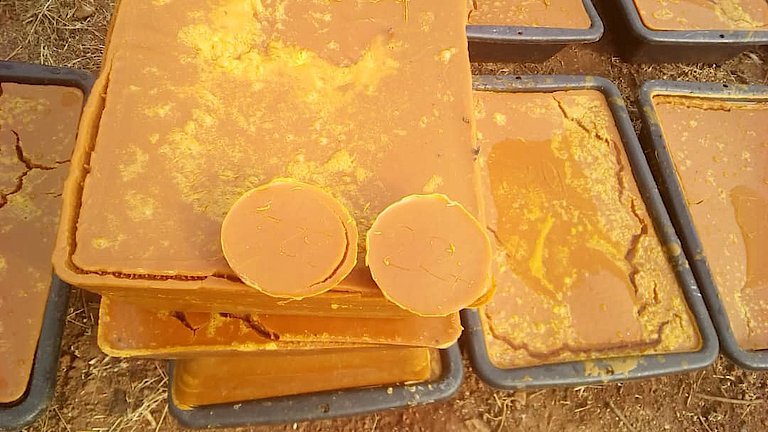

Southern African exports of Baobab powder as a nutritional and food supplement had grown to 438 tonnes per annum by 2020, with estimated local market sales of 288 tonnes. International oil sales, mostly to the cosmetics sector, were at seven tonnes and oil sales in southern Africa amounted to 11 tonnes. Many small businesses are engaged in processing and value-addition. Baobab is still a niche product, but there is a lot of growth potential.

COMPLIANCE WITH INTERNATIONAL MARKET REQUIREMENTS

Baobab powder is registered as a Novel Food in the European Union, and in the US as an FDA GRAS (Generally Recognised As Safe) ingredient. These registrations opened the door for regulatory approval in other territories internationally.

Sustainability

The harvesting of Baobab fruit, from which the powder and oil is derived, is sustainable because the tree is not removed or damaged, and Baobab is not on the CITES list of endangered species. Guidelines have been developed to train harvesters, and mechanisms are in place to minimize waste during production.

A sectoral approach to the Baobab industry

The African Baobab Alliance (ABA) was established in 2018 by producers, traders and brands from around the world. The ABA believes a strong baobab sector will create new economic opportunities for low-income rural communities in Sub-Saharan Africa. Its members produce, process and add value to Baobab to supply natural ingredients and products to the food, beverage, cosmetics and personal care industries.

A sector development plan for Baobab was developed in 2021 with technical support from the GIZ ABioSA project, in consultation with the ABA and other stakeholders. The main aims of the plan are to promote growth of the baobab sector and demand for its ingredients and products, improve its competitiveness and sustainability, and promote adoption of common quality standards.

The ABA is also investing in research into Baobab health and functionality claims, and developing a pan-African approach to access and benefit-sharing (ABS).

Over the period to 2026, development of the Baobab sector is expected to have the following impact in the SADC region:

- 200% growth in the volume and value of trade in baobab products

- 20,000 new rural harvesters are brought into the baobab value chain

- 2,500 new seasonal jobs are created

- Annual production of baobab fruit increased by 9,000 MT/yr.

Long term goals

- A million rural African women benefit from the sale of Baobab fruit every year

- 10 million hectares of Baobab woodland are effectively conserved and managed

- 300 million tonnes of carbon are sequestered every year in actively managed Baobab woodland

- The Baobab industry is worth over a billion US dollars a year to Africa

Contact the African Baobab Allicance:

info(at)africanbaobaballiance.org

Website of the African Baobab Alliance

+263 7 7226 9834 / +263 772211231